Table of Contents

Introduction

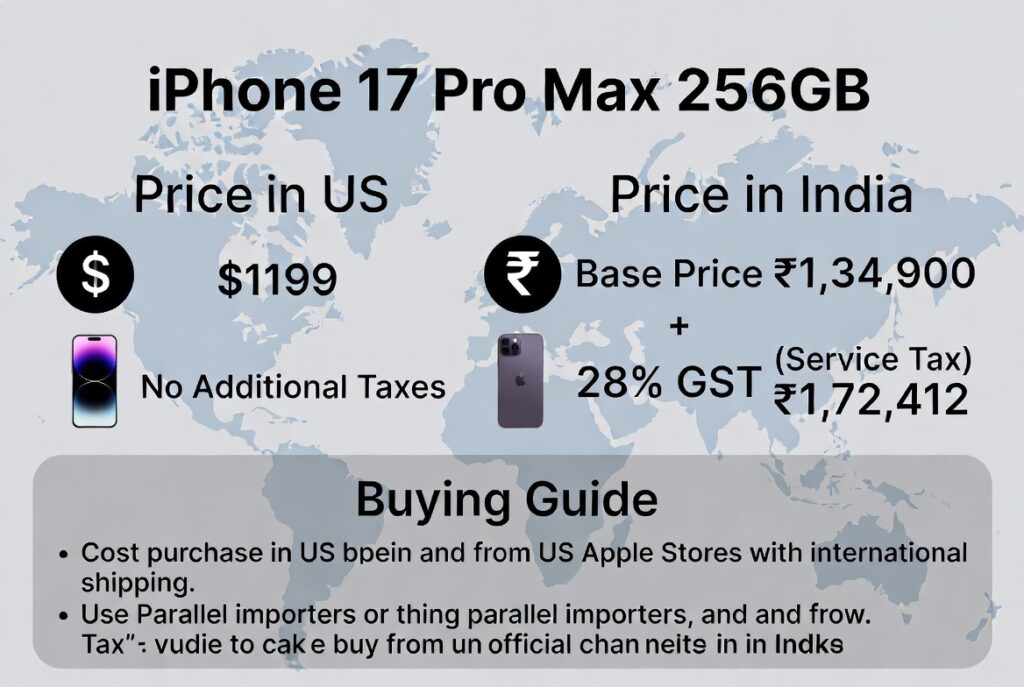

If you keep track of smartphone releases, you might have heard of this name: iPhone 17 Pro Max, especially the 256GB variant. Its starting price in the US may seem attractive—but when you try to bring it to India or compare it with Indian retail stores, things get complicated. Between exchange rates, taxes, customs, and import duties, the final price can vary significantly.

This article gives you a detailed breakdown of costs: from US retail prices to what you might pay in India, in a case study-style format. No nonsense. Just numbers and clear steps.

Problem – Why are you confused about iPhone prices?

US price vs Indian final cost

Smartphones released in the US often have a clear MSRP (Manufacturer’s Suggested Retail Price). However, this price doesn’t reflect what someone in India will actually pay. When you factor in US sales tax, currency conversion, customs duties, GST, and shipping or handling fees, the final amount can increase significantly.

Impact of taxes, import duties, and exchange rates

Each layer adds cost:

- Sales tax varies by US state.

- Currency conversion adds uncertainty – the rate fluctuates daily.

- Significant margins can be derived from customs duty and VAT in India.

- Additional costs such as shipping, handling and customs processing may also apply.

If you leave out one or more of these, your calculations will be inaccurate. And this is where disappointment or unintentional overspending comes in.

Movement – What happens without accurate information?

Surprise at the checkout

You might think you’re just paying the sticker price – but when all the costs are added up, you end up with a hefty bill. The gap between expectation and reality can be frustrating.

Misleading expectations

What used to be cheap on Amazon US or a retail site suddenly becomes more expensive after conversion and taxes are factored in. The feeling of “I saved money” immediately vanishes.

Risk of paying too much

Some buyers even pay more than the local retail price – defeating the very purpose of importing.

The frustration of hidden costs can overshadow any benefits from imports.

Solution – How this article helps

This article acts as a ready-made calculator. By taking into account every aspect – base price, US taxes, exchange rate, import duty, GST – you’ll get a realistic estimate of your final cost.

Plus, the iPhone 17 Pro Max 256GB case study will give you a clear picture before placing an international order. Think of it as a checklist to avoid any unpleasant surprises.

What we know: Base price in the United States

Historically, flagship iPhones have followed similar pricing patterns across generations. For example, the 256GB variant of the previous Pro Max model (think iPhone 15 Pro Max) costs around $15.US$1.199.

If there are no big jumps, we can estimate the iPhone 17 Pro Max 256GB at the US retail price of USD 1.199–1.249. For simplicity and to remain conservative, let’s set our base price for the case study to US$1,199.

Sales tax in the United States

Variation by state

The listed price (USD 1,199) often does not include sales tax, as sales tax in the US varies by state. Tax rates vary widely – from 0% in some states to over 9-10% in others.

Example States and Tax Rates

- State A (for example, Delaware, where there is no sales tax)→ 0%

- State B (for example, California or New York)→ about 8–9%

- State C (e.g., states with high combined taxes)→ about 9–10%

How Sales Tax Affects Actual Spending

If you make a purchase in a state with an 8.5% tax:

- Additional cost = 1,199 × 0.085 =US$101.92

- Total expenditure in the United States =USD ~1.300,92

The total amount will be US$1,199 if tax-free.

So, depending on the state, your US expenses can vary between approximately US$1,199 and US$1,301.

Importing into India or Buying in India: Additional Costs

If you are buying in the US and importing to India or buying a locally imported unit, you should also consider these things:

Customs duties and VAT

Indian customs duty – and GST – on mobile phones can be quite high. The exact rate depends on government policy at the time of import. For simplicity, let’s assume that taxes + taxes equal 20–25%of CIF value (cost + insurance + freight).

USD to INR conversion

You will need to convert your USD payment (including taxes) into Indian Rupees at the applicable exchange rate.

other costs

Shipping costs, handling costs, customs duties, and possible brokerage fees are also part of the final cost. These vary depending on the courier or freight company. For simplicity, we’ll add a small fixed buffer to our case study.

Exchange rate considerations

Current USD to INR exchange rate (estimated rate)

At the time of writing, the typical rate used for negotiations is approximately₹83 per US dollar(Note: This fluctuates daily – sometimes ₹82, sometimes ₹85 or more.)

Fluctuation risk

The rate may change by the time your order is shipped. Even a small change (e.g., from ₹83 to ₹85) can make a big difference.

Therefore, it is wise to check the real-time rates before making calculations.

Case study: iPhone 17 Pro Max 256 GB – Total cost for Indian buyer (if imported)

Let’s look at these numbers step by step:

- Base Price (US): 1.199 US Dollars

- US sales tax (let’s say it’s 8.5%)USD ~101.92

- Total payments in the United States USD ~1.300,92

Conversion to INR (₹83/USD):- 1.300,92 × 83 =₹ 108.976,36

- 1.300,92 × 83 =₹ 108.976,36

- Customs duty + VAT (average ~22%):

- At ₹108,976.36 → ₹ ≈ 23,974.80

- At ₹108,976.36 → ₹ ≈ 23,974.80

- Other costs (shipping costs, handling, customs buffer):

- Estimated Fixed Price ₹ 3,000

- Estimated Fixed Price ₹ 3,000

- Final Landing Cost in India:

- ₹108.976,36 + ₹23.974,80 + ₹3.000 =₹ 135.951,16≈₹ 136,000

- ₹108.976,36 + ₹23.974,80 + ₹3.000 =₹ 135.951,16≈₹ 136,000

So if you import the iPhone 17 Pro Max 256 GB from the USA, you may have to pay around…₹ 136,000Inclusive of all taxes and costs – based on the figures used above.

Ask yourself: Is it cheaper than buying locally, even after the margin, or is it about the same?

Case Study: Local Shopping in India (Rated Retail Price)

What usually happens when sold locally by authorized retailers or distributors in India:

- The price includes customs duty, VAT, retailer/distributor margin, warranty coverage, local after-sales support, etc.

- Retailer storage + VAT often causes the price to exceed the landed cost – especially when demand is high.

- Additional overhead costs incurred by the retailer on import handling may also increase costs.

Keeping this in mind, the local retail price of the iPhone 17 Pro Max 256 GB in India could be realistic₹ 150,000 – ₹ 160,000(This is an imaginary range), which depends on the absorption of taxes, margins, and import costs.

So sometimes the cost can be lower if you import it yourself – but there won’t always be much difference.

What you should pay attention to

Warranty issues

If you import, warranty support in India may be limited or voided. Official service centers may refuse to provide warranties for units imported into the US.

Network Compatibility

US variants sometimes differ in supported LTE/5G bands compared to the Indian model. This may impact connectivity in India.

Post-purchase assistance

Local buyers usually have easy access to accessories, repairs, or replacements. Imported phones may present problems or additional costs.

Tips for Indian buyers considering purchasing from the United States

- Calculate landing costs correctly— Don’t just go by the US price. Use the method above.

- Check the warranty terms– Make sure you’re okay with a limited or no warranty in India.

- Follow the exchange rate closely.– Small fluctuations can significantly change the final cost.

- Consider additional risks— Shipping damage, customs delays, compatibility issues.

- Compare the local retail price, the difference may be small or negligible after all costs are accounted for.

Options: Wait for the official launch in India or buy locally

If the difference between the imported cost and the local retail price isn’t too much – and warranty and support are also factored in – then waiting for the official release in India would be a wiser move.

Official retailers offer easy support, no worries about customs duties, and often EMI or bank offers at launch.

For many buyers, convenience is more important than minor savings.

Summary of key figures

| Calculation steps | Values/Perception |

| US base price (256GB) | US$1.199 |

| US sales tax (assumed 8.5%) | USD ~101.92 |

| Total US spending | USD ~1.300,92 |

| Conversion rate in INR | ₹83 / USD |

| Cost of converting INR | ~ ₹ 108.976 |

| Customs Duty + VAT (assumed 22%) | ~ ₹ 23.975 |

| Shipping and Handling Buffer | ₹ 3,000 |

| Estimated final cost when imported | ~ ₹ 136,000 |

| Approximate local retail price in India | ~ ₹ 150,000 – ₹ 160,000 |

Note: These are rough estimates based on assumptions. Actual costs may vary depending on exchange rates, government taxes, changes in customs duties, shipping costs, and retailers’ margins.

conclusion

If you are thinking of importingiPhone 17 Pro Max 256GBTo fly from the US to India, it’s important to look beyond the sticker price. If you factor in US sales tax, currency conversion, customs duties, GST, and shipping or clearance fees, you could end up paying around $10,000.₹ 136,000(assuming current rates and moderate taxation) compared to the likely local retail price of approx.₹ 150,000–₹ 160,000The savings are minor.

There are also some trade-offs: warranty limitations, potential network compatibility issues, and difficulty with after-sales service. For many buyers, it makes more sense to pay a little extra for convenience, support, and peace of mind.